Medicare > Articles

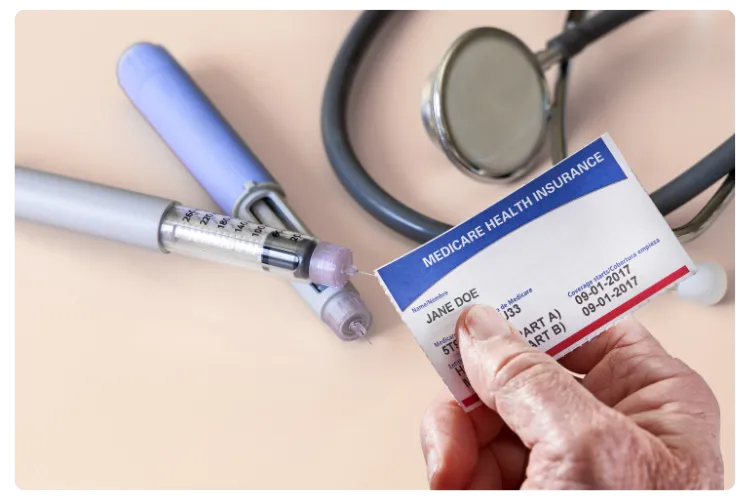

Will Medicare Pay for Ozempic?

Ozempic is a medication commonly prescribed to help manage type 2 diabetes by lowering blood sugar levels. Many individuals wonder if Medicare will cover the cost of Ozempic, as managing diabetes can involve significant medication expenses. While Medicare does provide coverage for certain prescription drugs, coverage for Ozempic and other diabetes medications can vary depending on the specific Medicare plan and coverage criteria.

Medicare Coverage for Prescription Drugs:

Medicare provides coverage for prescription drugs through Medicare Part D, which is offered by private insurance companies. Each Part D plan has its own formulary, or list of covered drugs, and may have different coverage criteria and cost-sharing requirements.

Determining Medicare Coverage for Ozempic:

To determine if Medicare will cover the cost of Ozempic, individuals should review their Medicare Part D plan's formulary or contact their plan directly. It's important to check if Ozempic is included on the formulary and whether any coverage restrictions or prior authorization requirements apply.

Alternative Options for Diabetes Management:

If Medicare does not cover the cost of Ozempic or if coverage is limited, there are alternative options available for managing type 2 diabetes:

Talk to Your Healthcare Provider:

Discuss alternative diabetes medications or treatment options with your healthcare provider to find a medication that is covered by your Medicare plan and meets your healthcare needs.

Explore Patient Assistance Programs:

Some pharmaceutical companies offer patient assistance programs that provide free or discounted medications to individuals who meet certain eligibility criteria. These programs can help reduce the cost of Ozempic for eligible individuals.

Consider Switching Medicare Plans:

If your current Medicare Part D plan does not provide adequate coverage for Ozempic, you may consider switching to a different Part D plan during the annual enrollment period to find a plan that covers your medication at a lower cost.

While Medicare may cover the cost of Ozempic for some individuals, coverage can vary depending on the specific Medicare plan and formulary. It's important for individuals to review their Medicare plan's coverage and explore alternative options for managing diabetes to ensure they have access to the medications and treatments they need.

NEED HELP?

FAQs

Does Medicare cover the cost of Ozempic?

Medicare may cover the cost of Ozempic if it is included on the individual's Medicare Part D plan's formulary and meets coverage criteria.

How can I find out if Ozempic is covered by my Medicare plan?

You can review your Medicare Part D plan's formulary or contact your plan directly to determine if Ozempic is covered and what coverage restrictions may apply.

Are there alternative options for managing diabetes if Medicare does not cover Ozempic?

Yes, alternative options may include switching to a different diabetes medication covered by your Medicare plan, exploring patient assistance programs, or considering switching Medicare plans.

Can I change my Medicare Part D plan to one that covers Ozempic?

Yes, you can change your Medicare Part D plan during the annual enrollment period to find a plan that covers Ozempic at a lower cost.

Where can I get more information about Medicare Part D coverage for diabetes medications?

You can learn more about Medicare Part D coverage by contacting your Medicare plan or consulting with a health insurance agent at Daza Insurance.

For Inquiries

CONTACT

Luis Daza

I am an Insurance agent who has had the privilege of serving, and the honor of gaining the trust and loyalty of our local senior community since 2008 - over 15 Years.