Medicare > Articles

Which Medicare Supplement is the Best?

Choosing the best Medicare supplement can be an important decision to ensure you have comprehensive and adequate health coverage. Medicare supplements, also known as Medigap plans, are designed to help cover costs that Original Medicare (Parts A and B) doesn't cover, such as deductibles, copayments, and coinsurance.

Here are some steps you can take to determine which Medicare supplement is the best for you:

Understand Your Coverage Needs:

Before choosing a Medicare supplement, consider your current and future healthcare coverage needs. Evaluate your typical and anticipated medical expenses, as well as your preferences regarding healthcare providers and access to specialized services.

Compare Available Medigap Plans:

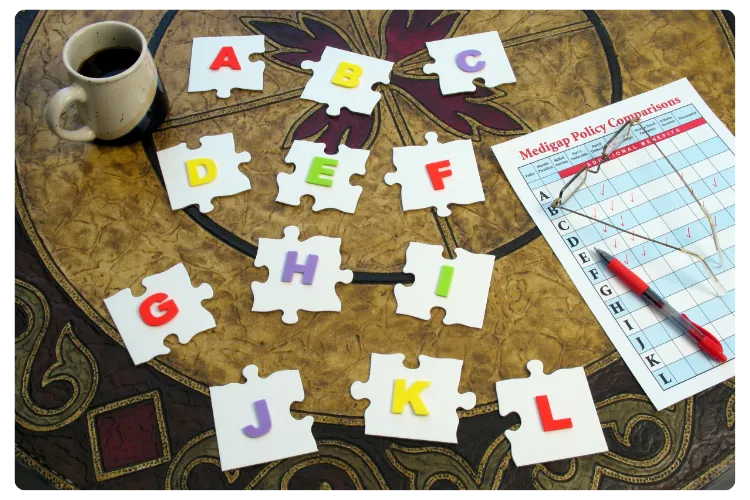

There are several Medigap plans available, each offering different levels of coverage and costs. Compare the benefits offered by each plan, as well as the monthly premiums and any other associated fees. Also, consider customer satisfaction ratings and the financial stability of the insurance company.

Consider Your Budget:

Make sure to choose a Medicare supplement that fits within your budget. While a plan with a lower monthly premium may seem appealing, it's important to consider the total costs, including deductibles and copayments, to determine the long-term affordability of the plan.

Consult with a Health Insurance Agent:

An experienced health insurance agent can help you understand your Medigap options and find the best plan for your needs. They can provide detailed information about each plan and help you make an informed decision.

By following these steps and seeking expert guidance, you can select the best Medicare supplement that complements your health coverage and provides you with peace of mind and financial security.

NEED HELP?

FAQs

What is a Medicare supplement?

A Medicare supplement, or Medigap plan, is a private insurance designed to cover costs that Original Medicare doesn't cover.

What is the difference between Original Medicare and a Medicare supplement?

Original Medicare (Parts A and B) is administered by the federal government, while Medicare supplements are offered by private insurance companies.

When can I enroll in a Medicare supplement?

You can enroll in a Medicare supplement during your Initial Open Enrollment Period, which begins when you turn 65 and enroll in Medicare Part B.

For Inquiries

CONTACT

Luis Daza

I am an Insurance agent who has had the privilege of serving, and the honor of gaining the trust and loyalty of our local senior community since 2008 - over 15 Years.